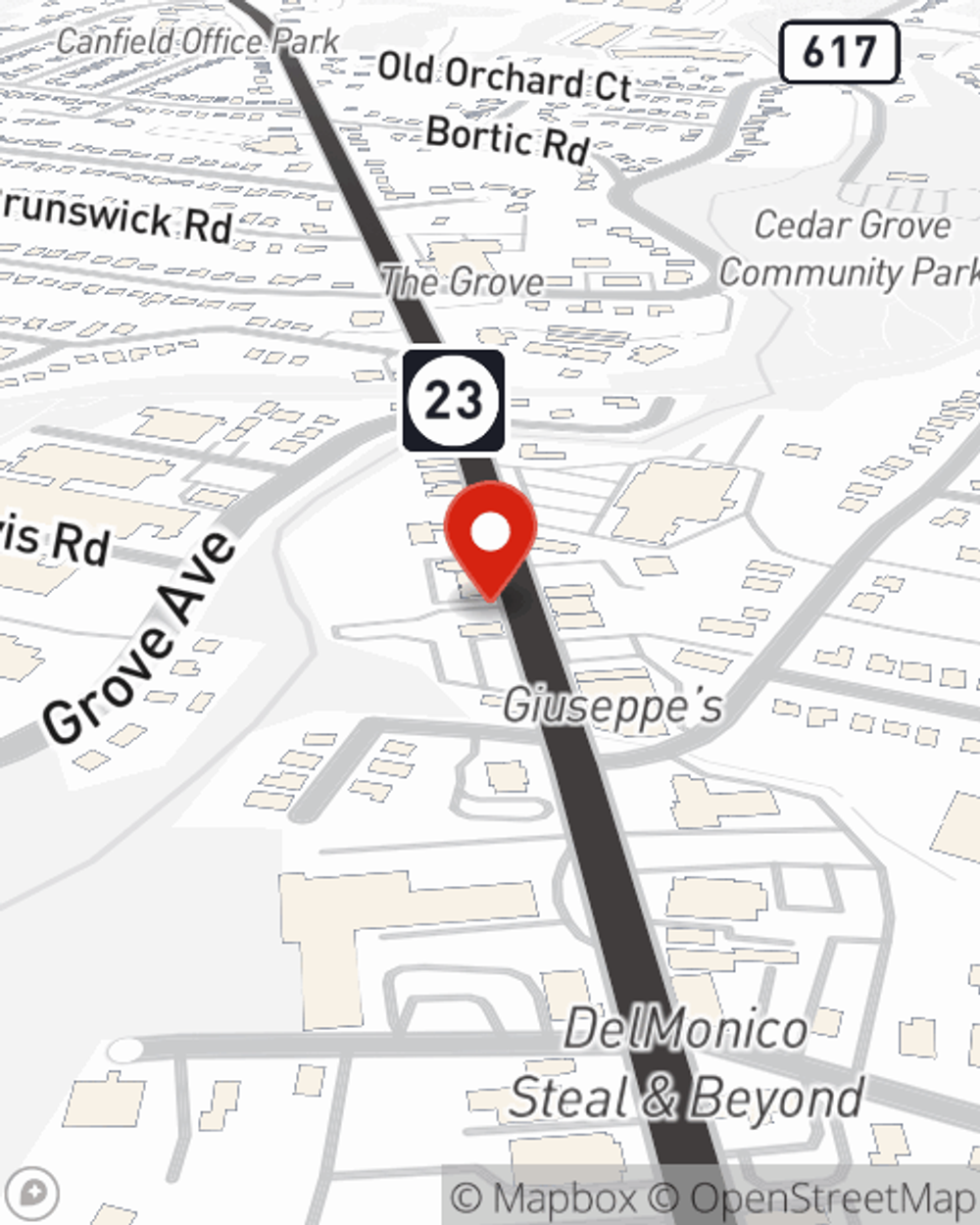

Business Insurance in and around Cedar Grove

One of the top small business insurance companies in Cedar Grove, and beyond.

Insure your business, intentionally

- Verona

- Little Falls

- Wayne

- Montclair

- Clifton

- Bergen County

- Essex County

- Morris County

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of challenges. You shouldn't have to wrestle with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including extra liability coverage, worker's compensation for your employees and a surety or fidelity bond, among others.

One of the top small business insurance companies in Cedar Grove, and beyond.

Insure your business, intentionally

Cover Your Business Assets

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a photography studio, a cosmetic store or an art school. Agent Edwin Mata is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Call Edwin Mata today, and let's get down to business.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Edwin Mata

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.